AI NATA - what it is?

AI NATA was developed by a team of top-level programmers and mathematicians from the Russian Academy of science. TEAM LEAD KONSTANTIN CHUGALINSKY. Developed since 2019.

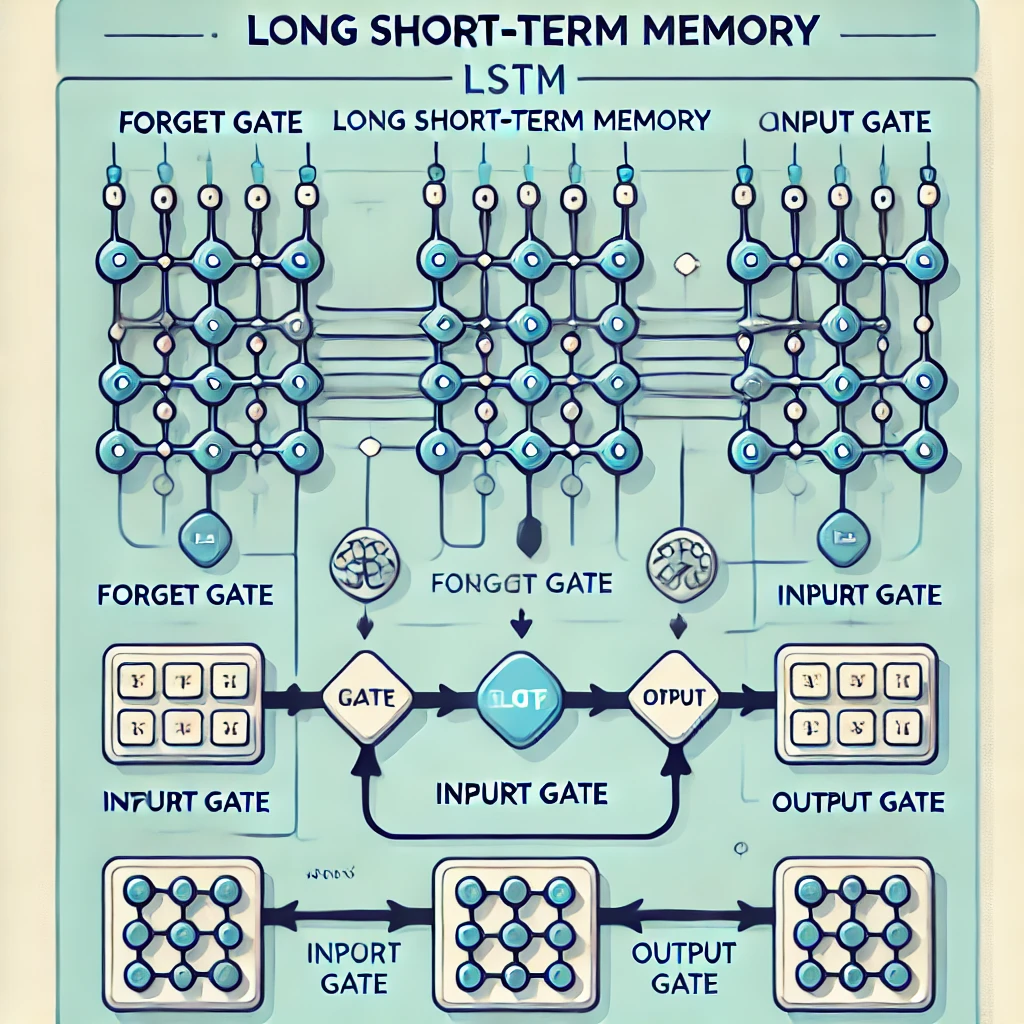

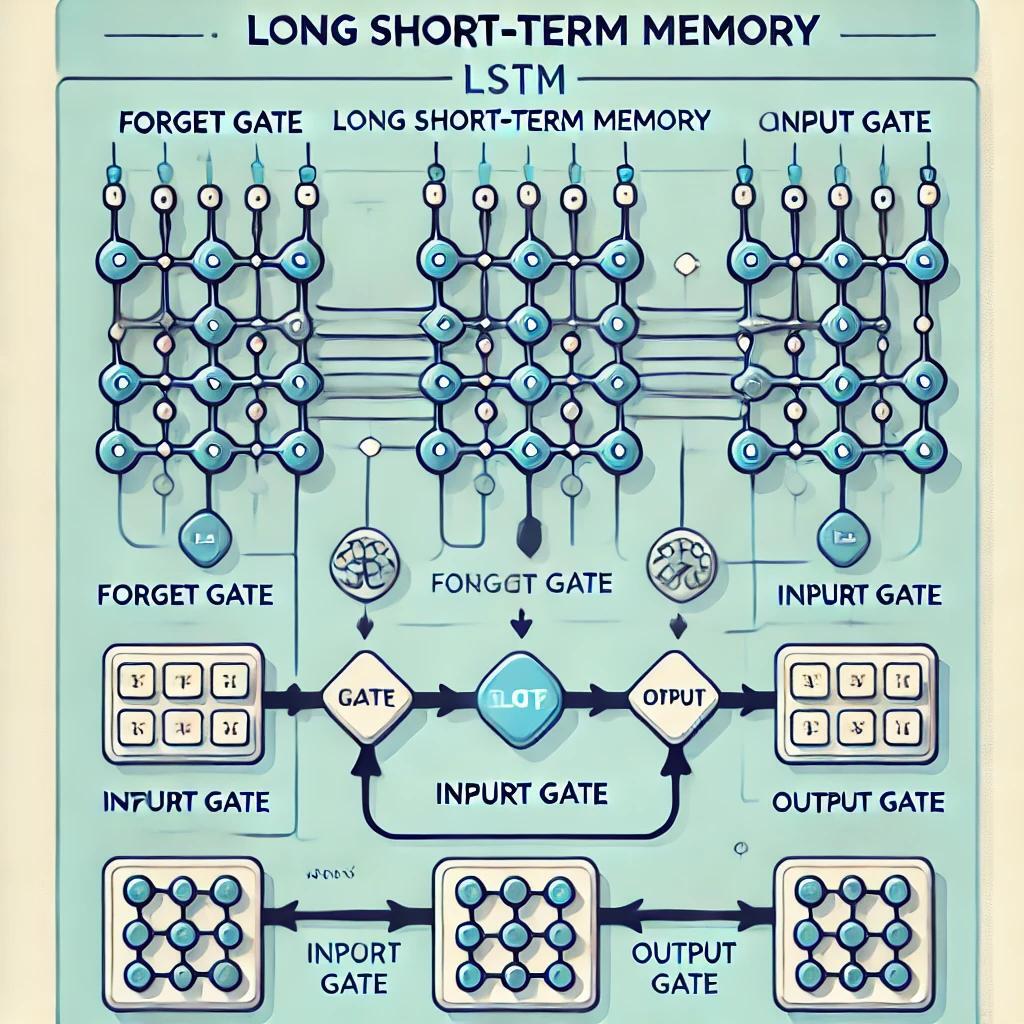

The foundation of AI NATA is the LSTM neural network. This is a recurrent neural network used for deep learning tasks, including forecasting financial time series.

The foundation of AI NATA is the LSTM neural network. This is a recurrent neural network used for deep learning tasks, including forecasting financial time series.

LSTM Neural Network: How It Works and Why It's Use

An LSTM (Long Short-Term Memory) neural network is a type of recurrent neural network (RNN) specifically designed to handle sequential data and overcome the limitations of standard RNNs, such as the vanishing gradient problem. This makes LSTMs particularly effective for tasks where the context and relationships between data points over time are crucial, such as:

- Time-series forecasting (e.g., stock prices, weather data, or cryptocurrency trends like in AI NATA).

- Natural language processing (e.g., text generation, translation).

- Speech recognition and audio analysis.

Key Features of LSTM

- Memory Cells: LSTM networks have a structure that allows them to maintain and control a "memory" over long sequences of data. This memory is updated and retained based on input data, making LSTMs suitable for learning long-term dependencies.

- Gates: LSTM units use gates to control the flow of information. These gates are neural networks themselves, trained to decide what information to keep or forget:

- Forget Gate: Decides what information should be discarded.

- Input Gate: Determines what new information to store in the cell state.

- Output Gate: Controls what part of the memory is used for the current output.

- Cell State: The "memory" of the LSTM is carried through the network in the form of a cell state, which can store relevant information for long durations.

- Training Through Backpropagation: Unlike traditional RNNs, LSTMs are better at retaining information over many training steps, making them ideal for long sequences.

How LSTM is Applied in AI NATA

In the context of the AI NATA system:

- The LSTM processes historical financial data (time series of BTC prices) to recognize patterns and trends.

- It uses its memory mechanisms to predict future price movements, leveraging long-term dependencies in the data.

- The sliding window mechanism ensures that it continuously trains and adapts its predictions to recent market conditions.

For example:

- Neural Network #1 identifies trends and predicts BTC price changes for the next three hours using LSTM to analyze time-series data and detect cyclical patterns.

- The combination of LSTM's memory and gating system enables it to provide more accurate predictions compared to traditional models.

LSTM Network Architecture

The architecture of an LSTM network resembles a chain consisting of several modules, each comprising four layers that interact in a specific way. The main distinction of this network is its ability to pass state information from one module to the next. Each module can either forget part of this information or add new data, creating the "memory" effect.

A similar technology powers the well-known ChatGPT.

LSTM networks are particularly effective for working with data where long-term memory is crucial. They are also less susceptible to the vanishing gradient problem.

To produce a relevant forecast, AI NATA requires a sliding data window to pass through three blocks, each representing a separate neural network trained and tuned for a specific function.

Neural Networks in AI NATA

Neural Network #1: Analyzing Market Trends

Purpose: Analyzes the current market situation and predicts the BTC price direction, aggregated into 3-hour candlesticks.

Methods of Data Analysis:

- Time Series Analysis: Identifies trends and cyclical patterns in BTC price dynamics.

- Cluster Analysis: Groups objects into clusters based on their similarity.

Cluster analysis is used to combine objects into groups (clusters) based on their similarities. Time series analysis is applied to observe trends over time, studying coin price charts to identify cycles and patterns. These methods help identify hidden trends and regularities in BTC price dynamics.

Based on weights and the previous 24-hour data, Neural Network #1 predicts BTC price movements for the next three hours:

- 1st hour: up to 78% accuracy

- 2nd hour: up to 69% accuracy

- 3rd hour: up to 58% accuracy

Neural Network #2: Cross-Validation

Purpose: Confirms the forecast from Neural Network #1 using a "Doubt Algorithm."

This network assesses AI NATA's confidence in its own predictions. Additional checks include:

- Technical analysis indicators: SMA, WMA, PSAR, MACD, EMA

- Oscillators and volume levels, ensuring robust validation.

Cross-validation, or "The Doubt Algorithm," is a mechanism used to verify the accuracy of prediction results. Essentially, this neural network indicates how confident AI NATA is in its own forecast.

In addition to the sliding window of data, cross-validation is enhanced by technical analysis indicators, including SMA, WMA, PSAR, MACD, and EMA—those with the most significant influence on forecast confirmation.

Thus, the validation of Neural Network #1’s decisions also takes place using oscillators, moving averages, and volume levels. These factors impact the final outcome.

Neural Network #3: Assessing Impulse Strength

Purpose: Determines the strength of the predicted price movement to avoid flat trades and find optimal exit points, increasing profitability. It provides recommendations for setting price markers.

As the AI NATA system has a prediction horizon of only 3 hours, and BTC quotes change every second, the trading bot must understand whether the current price changes align with AI NATA's forecast and if the trade should be closed or if the impulse is still building.

This prevents entering flat trades, exceeding the initial forecast horizon, and identifies more profitable exit points, ultimately increasing profit margins. Essentially, Neural Network #3 provides recommendations on where to place price markers.

Once the forecast is made, the final data is sent to the trading bot, which performs the mechanics of placing orders, Stop Loss, and Take Profit.

Trading Bot

The trading bot executes predefined algorithms based on AI NATA’s predictions, operating under an "if-then" framework.

Example:

- If AI NATA's forecast exceeds the threshold, place a long order for USDT/BTC with 10% of the deposit, a 1% Stop Loss, and a 1% Take Profit.

- If the order remains open for three hours, close it at the current market price.

Key Trading Parameters:

- Minimum thresholds for trade execution:

- Forecasted 3-hour trend in one direction (rise or fall) with:

- 1st hour: ≥70% confidence

- 2nd hour: ≥64% confidence

- Cross-validation confidence: ≥76%

- Impulse strength: ≥0.6 (equivalent to a 0.5%-0.6% BTC price change)

- Stop Loss remains constant at 1% price movement.

- Open positions may close early due to:

- Stop Loss triggering (incorrect forecast).

- Take Profit triggering (correct forecast).

- Timer expiration after 3 hours.

- Signal from neural networks indicating a trend change.

AI NATA Trading System Parameters:

- Instrument: Futures contracts

- Margin: Isolated

- Trading Pair: USDT/BTC

- Position Size: 10% of the deposit

- Leverage: x3

- Trade Duration: Up to 3 hours

- Trade Style: No averaging, scaling, or Martingale; single-entry, single-exit trades

- Frequency: Average of 2 trades per day

- Risk/Reward: 1:1 / 1:1.5

- Win Rate: ~81% (81 profitable trades out of 100)

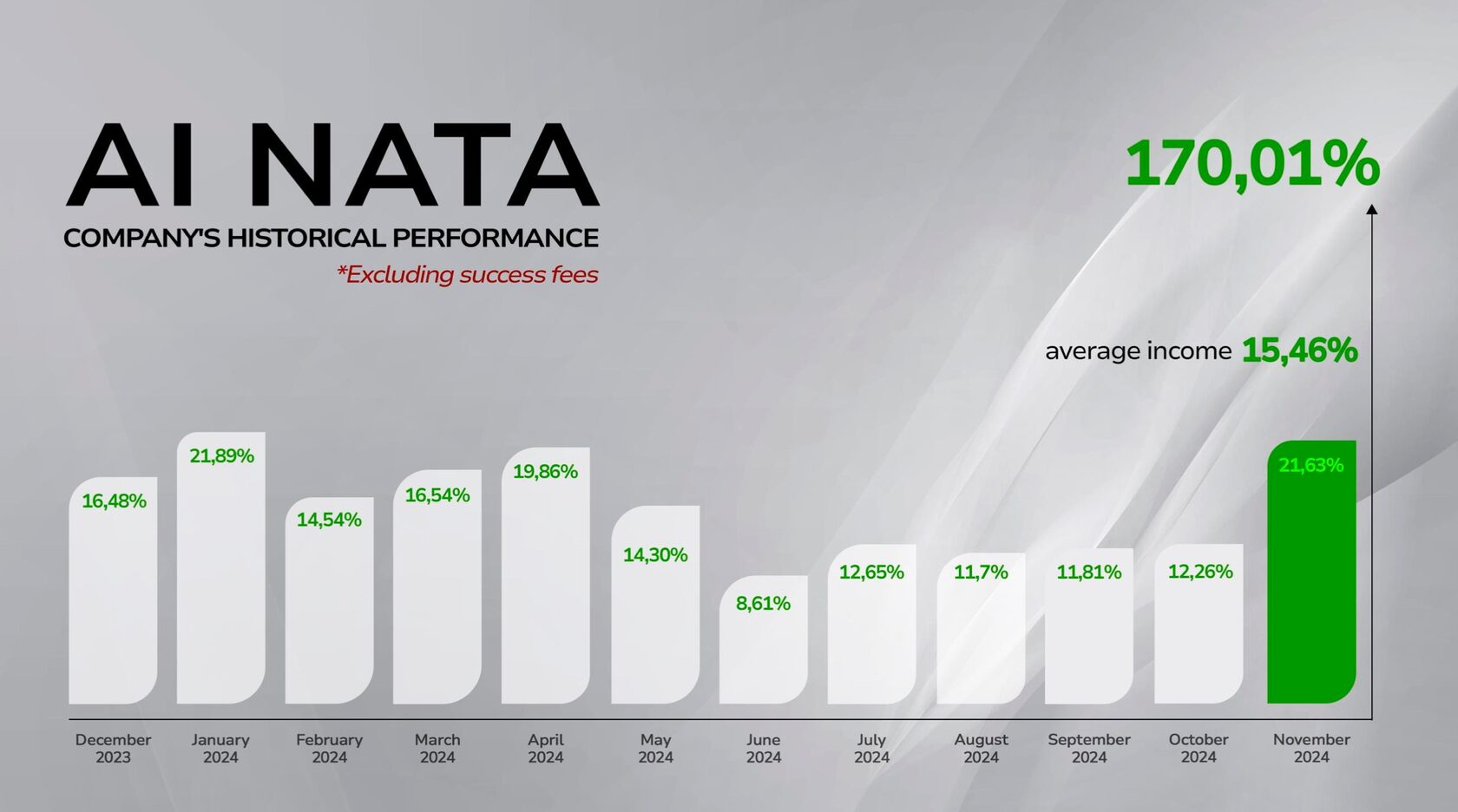

- Monthly Average ROI: ~16.3% over the past 6 months

The system continuously tracks market changes, enabling dynamic adjustments to Take Profit levels and early order closures while maintaining a consistent Stop Loss.